Non-Banking Financial Companies (NBFCs) play a crucial role in the Indian financial system, providing a wide range of financial services. With the growing importance of NBFCs, investors are keen on identifying the Top NBFC stocks in India that offer promising returns. This article aims to highlight some of the leading NBFC stocks in India and their potential for growth.

Why Choose NBFC Stocks?

NBFCs play a crucial role in India’s financial system by providing a wide range of financial services. These companies are well-positioned to benefit from the country’s economic growth and increasing consumption. Moreover, NBFCs often operate in niche sectors and have the potential to deliver higher returns compared to traditional banking stocks.

Top NBFC Stocks in India

Now let’s explore some of the top NBFC stocks in India that have shown significant potential for growth:

- Bajaj Finance Limited

– Bajaj Finance Limited has consistently delivered impressive financial performance, making it a top choice for investors

– Furthermore, its diversified product portfolio and strong customer base contribute to its sustained growth.

- HDFC Limited

– HDFC Limited, a leading NBFC in India, has a solid track record and is widely recognized for its sound financial management

– Additionally, it offers a range of financial products and services, catering to both retail and corporate customers.

- Shriram Transport Finance Company Limited

– Shriram Transport Finance Company Limited specializes in financing commercial vehicles and has established itself as a market leader in this sector

– Moreover, its extensive network and customer-centric approach make it a preferred choice among borrowers.

- Cholamandalam Investment and Finance Company Limited

– Cholamandalam Investment and Finance Company Limited has witnessed robust growth in recent years, backed by its strong presence in rural and semi-urban areas.

When looking for stocks with high growth potential, it is important to consider a few key factors such as the company’s financial health, industry trends, and market conditions. Here are some of the top NBFC stocks in India that have shown promising growth prospects:

Understanding NBFCs

Before we dive into the growth potential of NBFC stocks, let’s first understand what Non-Banking Financial Companies are. NBFCs are financial institutions that provide banking services such as loans, advances, credit facilities, and investment products, without holding a banking licence. Unlike banks, NBFCs do not accept savings deposits from the public.

NBFCs play a crucial role in the Indian financial system, catering to the diverse financial needs of individuals and businesses. With their innovative products and services, NBFCs have witnessed significant growth in recent years, becoming an attractive investment avenue for many.

Factors Driving the Growth of NBFC Stocks

- Regulatory Reforms:

The Indian government has introduced various regulatory reforms to promote the growth of NBFCs. These reforms include relaxed licensing norms, simplified regulatory frameworks, and enhanced transparency. Such reforms have boosted investor confidence and facilitated the growth of NBFC stocks in the market.

- Rising Demand for Credit:

India has witnessed a surge in credit demand, particularly among individuals and small businesses. Traditional banks often have strict lending criteria, making it challenging for these borrowers to access credit. NBFCs, with their flexible lending policies and customer-centric approach, have bridged this gap, meeting the rising demand for credit. The increasing customer base of NBFCs has directly impacted the growth potential of their stocks.

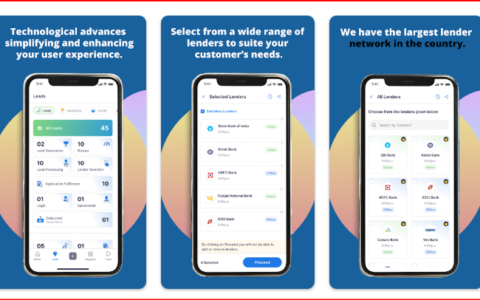

- Technological Advancements:

Technology has played a pivotal role in the growth of NBFCs. By adopting digital platforms, NBFCs have enhanced their operational efficiency, accelerated loan disbursals, and improved customer experience. These advancements have not only attracted more customers but have also positioned NBFCs as frontrunners in the financial sector. As technology continues to evolve, the growth potential of NBFC stocks is expected to further amplify.

- Investment from Foreign Institutions:

Foreign institutional investors have recognized the growth potential of NBFC stocks and have made significant investments in the Indian market. The inflow of foreign capital has injected liquidity into NBFCs, enabling them to expand their operations and fuel their growth. The positive sentiment of foreign investors has had a direct impact on the valuation of NBFC stocks.

Risks and Challenges

While NBFC stocks offer promising growth potential, it is essential to acknowledge the risks and challenges associated with investing in them. Some key risks include:

- Asset Quality Risk:

As NBFCs are chiefly engaged in lending activities, the quality of their loan portfolio is critical. Any deterioration in asset quality, including a rise in delinquencies or defaults, can significantly impact the profitability and stock performance of NBFCs.

- Liquidity Risk:

NBFCs typically rely on borrowings to fund their lending activities. Any disruptions in the availability of funds or a sudden increase in borrowing costs can pose a liquidity risk for these institutions. Investors should assess the liquidity position of NBFCs before investing in their stocks.

- Regulatory Risk:

While regulatory reforms have been favourable for the growth of NBFCs, any adverse regulatory changes can create uncertainty and impact their operations. Investors should stay updated with regulatory developments and assess the potential impact on NBFC stocks.

Strategies for Investing in NBFC Stocks

- Fundamental Analysis:

Before investing in NBFC stocks, it is crucial to conduct a thorough fundamental analysis. This includes assessing the financial health of the company, analyzing its business model, evaluating its management team, and understanding its competitive positioning in the market. Fundamental analysis helps investors make informed investment decisions.

- Diversify Your Portfolio:

Investing in NBFC stocks carries a certain level of risk. To mitigate this risk, it is advisable to diversify your portfolio by investing in stocks across different NBFCs. This diversification strategy helps in spreading the risk and maximising potential returns.

- Stay Informed:

The financial market is dynamic, and factors influencing NBFC stocks can change rapidly. Therefore, it is essential to stay informed about market trends, regulatory changes, and the financial performance of NBFCs. Regularly monitoring your investments and staying updated will help you make timely decisions.

Conclusion

The growth potential of NBFC stocks in the Indian market is substantial, driven by regulatory reforms, rising credit demand, technological advancements, and foreign investments. However, investors must also consider the risks and challenges associated with investing in NBFC stocks. By conducting thorough fundamental analysis, diversifying their portfolio, and staying informed, investors can make well-informed investment decisions in the NBFC sector. As always, consult with a financial advisor before making any investment decisions.