Gen Zs are known for the habit of “living in the moment” or getting into the practice of “living life in Kingstyle.” All these habits got accelerated and started to move on steroids as they started to enter the workforce.

Hence, for the banks, it’s the new age group of customers who are not financially literate and have quite a few responsibilities. Thus, they are the perfect demographic through which the financial institute can make a fortune.

If you are an individual who needs a loan but believes in making a calculative decision, you can consult with a loan DSA partner who can help you make a choice that will be financially beneficial for the client.

Reasons Why Gen-Zs Chooses to Use Credit

A Gen-Z consumer is someone who is poised to have options in a departmental store or is willing to have the option of multiple fashions, and through that, one can make the purchase decision. These impulses are pushing the Gen-Zs towards the utilization of credit so that they can get their hands on the most amazing items.

- Meeting the Urge of Immediate Gratification

The first reason for using credit options for Gen-Z consumers is the need for immediate gratification. This population segment is most used to instant gratification, and that pushes them to purchase more and keep that cycle continuing for short-term gratification.

Activities like savings and choosing long-term investments are the practice of delayed gratification, and due to that, one can’t save a lot and stay prone to using the credit option that brings gratification to the person.

- To Get Better Flexibility in Career Path

The next thing for which Gen-Zs are using credit is to have better accessibility in their career path. For example, a person who is looking to change careers in the industry is willing to go for the credit option that will help to cover the expenses.

- Having the Option of Digital Finance Ease

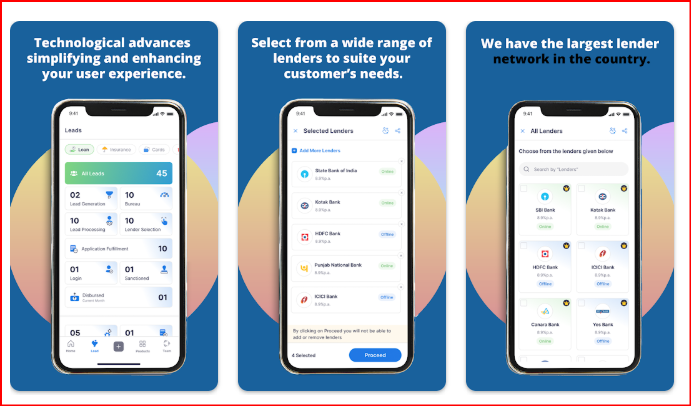

One of the greatest advantages and perils of today’s time is digital finance. It’s a financing option that allows an individual to have a banking facility available at home, and through that, one can make the purchase decision.

Today, while going to bed at night, a good offer from an e-commerce company allows a person to take a moment to check that item and make the purchase at a minimum price rate with the use of an EMI.

- Valuing Experiences Over Possessions

A shift in choices is also another reason why Gen-Zs are more prone to spending time at a cozy restaurant than making something at home. The experience of regality and service is worth more than possessions.

For example, a trip to Manali or Sikkim or a foreign location is something that needs to be done before the 30s. Now, these objectives are increasing the demand for credit, and people become prone to travel loans that will eventually help them to make their dreams happen.

- A Tendency to Build a Credit History

Finally, the need for a credit history is one of the reasons fueling the need for multiple credit cards, and through that, one can decide on the right option that will help them build a credit history.

Getting a good credit history is essential for Gen-Z individuals for future loan options. They can make the choice of getting a home loan or a car loan in the future, which pushes them to have a good credit score. Here, one can search for the best app for DSA, and there, they can get agents who can suggest good credit card options.

Concerns that Gen Zs Tends to Face

Certain concerns tend to arise for Gen Z individuals when it comes to getting leveraged with many credit options.

- A Potential Chance for Debt Accumulation

While credit is good for getting things immediately, it chokes a person if they are over-leveraged. The accumulation of debt creates a situation where a person might face the risk of credit failure and through that, one can fall under the debt trap.

Hence, all these problems occur when a person thinks of credit usage in Gen Zs, and the problem arises from short-term financial thinking.