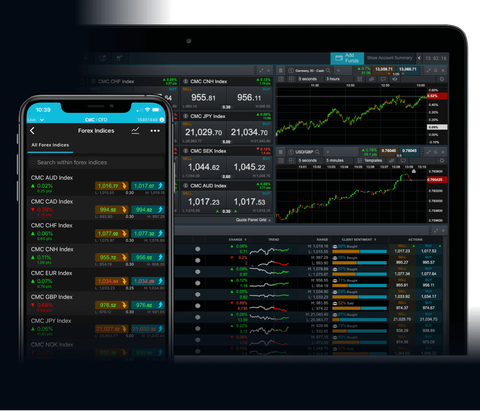

The foreign exchange market, often abbreviated as Forex, is a dynamic and vast global marketplace where currencies are bought and sold. In the world of Forex trading, currencies are categorized into three main groups: major, minor, and exotic pairs. Understanding the differences among these categories is crucial for traders seeking success in this intricate financial landscape. In this comprehensive exploration, we will delve into the distinctions between major, minor, and exotic currency pairs, offering insights into their unique characteristics and the factors that traders should consider.

Major Currency Pairs

Major currency pairs are the foundation of the Forex market, representing the most traded and liquid pairs globally. The key feature of major pairs is the inclusion of the U.S. Dollar (USD) as one of the currencies. The major pairs include:

- EUR/USD (Euro/US Dollar): The Euro is the base currency, and the U.S. Dollar is the quote currency.

- USD/JPY (US Dollar/Japanese Yen): The U.S. Dollar is the base currency, and the Japanese Yen is the quote currency.

- GBP/USD (British Pound/US Dollar): The British Pound is the base currency, and the U.S. Dollar is the quote currency.

- USD/CHF (US Dollar/Swiss Franc): The U.S. Dollar is the base currency, and the Swiss Franc is the quote currency.

Major pairs are characterized by their high liquidity, tight spreads, and relatively stable price movements. Due to these attributes, major pairs are favored by both institutional and retail traders for their accessibility and lower volatility compared to other categories.

Minor Currency Pairs

Minor currency pairs, also known as cross-currency pairs, do not include the U.S. Dollar. Instead, they involve two major currencies from different regions. Some examples of minor pairs include:

- EUR/GBP (Euro/British Pound)

- EUR/AUD (Euro/Australian Dollar)

- GBP/JPY (British Pound/Japanese Yen)

Minor pairs exhibit slightly higher spreads compared to major pairs, and their liquidity can vary. Traders interested in specific regional economic developments often explore minor pairs as they offer opportunities linked to those particular economies.

Exotic Currency Pairs

Exotic currency pairs involve one major currency and one from a developing or emerging-market economy. These pairs are characterized by lower liquidity, wider spreads, and increased volatility. Examples of exotic pairs include:

- USD/TRY (US Dollar/Turkish Lira)

- EUR/TRY (Euro/Turkish Lira)

- USD/SEK (US Dollar/Swedish Krona)

Exotic pairs are less commonly traded compared to major and minor pairs. Traders need to exercise caution when dealing with exotics due to their lower liquidity, which can result in potential slippage and higher transaction costs.

Factors to Consider When Trading Different Pairs

1. Liquidity

Liquidity is a crucial factor in currency trading. Major pairs, being the most liquid, provide easier entry and exit points for trades. This high liquidity also means that price manipulation is less likely. On the other hand, exotic pairs may have lower liquidity, leading to potential slippage and challenges in executing trades at desired prices.

2. Volatility

Volatility, or the degree of price variation, varies across different currency pairs. Major pairs, being more stable, are favored by traders who prefer less risk. Exotic pairs, however, tend to exhibit higher volatility, presenting both opportunities and challenges. While higher volatility can result in larger profits, it also increases the risk of substantial price fluctuations.

3. Spreads

The spread is the difference between the bid (selling) and ask (buying) prices. Major pairs usually have the tightest spreads, making them cost-effective for traders. Exotic pairs, due to their lower liquidity, may have wider spreads. Traders need to consider spreads, as they directly impact the overall cost of trading.

4. Risk Tolerance

Traders should align their choice of currency pairs with their risk tolerance and overall trading strategies. Major pairs are often preferred by those seeking stability and lower risk. Traders comfortable with higher risk may find exotic pairs appealing, despite their increased volatility and potential challenges.

Trading Strategies for Different Pairs

Strategies for Major Pairs

Major pairs are well-suited for traders employing trend-following strategies or relying on technical analysis. Their liquidity and stability make them attractive for both short-term and long-term trading approaches.

Strategies for Minor Pairs

Minor pairs can be ideal for traders with a regional focus or those interested in specific economic developments. These pairs may respond well to fundamental analysis, considering the economic factors influencing the respective regions.

Strategies for Exotic Pairs

Trading exotic pairs requires a cautious approach due to their increased volatility and lower liquidity. Traders may benefit from using longer timeframes, employing risk management strategies, and staying informed about economic events in the involved countries.

Conclusion

In conclusion, exploring major, minor, and exotic currency pairs provides traders with a diverse range of opportunities. Each category has its unique characteristics, presenting both advantages and challenges. Major pairs offer stability and liquidity, minor pairs provide regional exposure, and exotic pairs bring opportunities for higher returns but with increased risk.

Traders need to carefully evaluate their risk tolerance, trading goals, and strategies when choosing which currency pairs to trade. The Forex market’s dynamic nature allows traders to adapt and seize opportunities across the global currency landscape. By understanding the intricacies of major, minor, and exotic pairs, traders can make informed decisions and navigate the ever-evolving world of currency trading with confidence.

Trading Strategies for Different Pairs

Strategies for Major Pairs

Major pairs are well-suited for traders employing trend-following strategies or relying on technical analysis. Their liquidity and stability make them attractive for both short-term and long-term trading approaches.

Strategies for Minor Pairs

Minor pairs can be ideal for traders with a regional focus or those interested in specific economic developments. These pairs may respond well to fundamental analysis, considering the economic factors influencing the respective regions.

Strategies for Exotic Pairs

Trading exotic pairs requires a cautious approach due to their increased volatility and lower liquidity. Traders may benefit from using longer timeframes, employing risk management strategies, and staying informed about economic events in the involved countries.

Conclusion

In conclusion, exploring major, minor, and exotic currency pairs provides traders with a diverse range of opportunities. Each category has its unique characteristics, presenting both advantages and challenges. Major pairs offer stability and liquidity, minor pairs provide regional exposure, and exotic pairs bring opportunities for higher returns but with increased risk.

Traders need to carefully evaluate their risk tolerance, trading goals, and strategies when choosing which currency pairs to trade. The Forex market’s dynamic nature allows traders to adapt and seize opportunities across the global currency landscape. By understanding the intricacies of major, minor, and exotic pairs, traders can make informed decisions and navigate the ever-evolving world of currency trading with confidence.