A Personal Loan without any security is sometimes the best option when borrowing money for most necessities. You have quick access to these funds and can use them for anything, including paying for school expenses, home improvements, handling emergencies, and maintaining a healthy savings account.

Applying for a Personal Loan with customised conditions is essential to get the most out of it. Using a Personal Loan interest rate calculator to compare instruments is the quickest approach to finding such deals.

The EMI Calculator determines your repayable EMI by using the many characteristics of your loan, such as the Personal Loan interest rate, Personal Loan eligibility criteria, and loan tenure. These elements will impact your choice, and you can rely on precise information.

Before applying for a loan, let’s learn more about it and the advantages of using a personal loan interest rate calculator.

What Does A Calculator For Personal Loans Mean?

You can calculate the prospective EMIs for your loan using a free online tool called an “EMI Calculator” or “Personal Loan interest rate calculator.” You may work out the maximum loan amount you can take out and still afford to pay it back without straining your monthly budget.

The principal amount, interest rate, and loan tenure are the three key factors taken into account by the PL calculator to determine your loan EMI value. All you have to do to use the Personal Loan eligibility calculator is:

- Visit the lender’s website, where the Personal Loan interest rate calculator is located.

- Put the values for the principal, interest, and tenure in.

- Select “Calculate”

- Your possible EMIs will be calculated quickly by the Personal Loan EMI Calculator. If the results exceed your ability to repay, you can keep changing the parameters until you get the desired outcome.

Using a Personal Loan EMI Calculator in India has four major advantages.

Offers a Quick and Simple Method to Calculate Loan EMIs

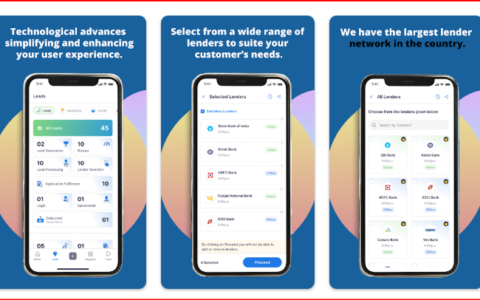

Many lenders have simplified the process by providing easy-to-use Personal Loan interest rate calculators on their websites, making them accessible on smartphones for on-the-spot calculations.

You only need to input basic loan details to get immediate results without sharing personal information. These free tools often come with handy links for hassle-free online applications, ensuring a smooth and well-informed lending experience.

Does Not Require Manual Calculation

With the user-friendly EMI Calculator, borrowers can sidestep the complexities of manual calculations. Enter your desired loan amount, personal loan interest rate, and loan term to compute your repayment amount instantly.

This convenient tool eliminates the need for laborious formula-based computations, reducing the likelihood of errors. Count on the EMI Calculator for precise and swift calculations across all Personal Loan choices, guaranteeing the accuracy of your total repayment estimates.

Provides Information on the Whole Payback Process

Gain insights into your repayment patterns and EMI details with the help of a Personal Loan interest rate calculator. It offers an easy-to-understand amortisation schedule, breaking your total loan into principal and interest components.

This graphical representation is invaluable when strategising prepayments, allowing you to decide when to pay and maximise your interest savings.

Aids in Cost Comparison of Offerings

EMI Calculators simplify loan comparisons, allowing you to effortlessly explore various terms and offers. Determine affordability by examining EMI and interest costs with a known interest rate. This ensures you make an informed choice and apply confidently for the best Personal Loan deal.

Consider your repayment capacity and loan term before applying to avoid budget strain. Opt for a flexible tenure of up to 60 months with approvals up to INR 25 lakh, ensuring manageable expenses throughout your loan journey.

Wrapping Up

Personal Loans are the best option if you’re seeking an unsecured Personal Loan eligibility with various uses. However, you must conduct adequate research before applying for one. This entails contrasting interest rates, using a Personal Loan EMI Calculator to calculate future EMIs, and carefully reading all terms and conditions. After choosing your desired Personal Loan interest rate calculator option, submit an online application to your bank.